- Rishikesh Sreehari, Shubham Thakare

At the commencement of COP 26, India announced to achieve net-zero emissions by 2070 and submitted updated nationally determined contributions (NDCs) to the United Nations Framework Convention on Climate Change(UNFCCC), reaffirming its commitment to reduce emission intensity by 45 percent from 2005 levels by 2030. The decarbonisation of the energy sector, which contributes to nearly 75 percent of the total greenhouse gas (GHG) emissions, is heavily dependent on integrating renewables, particularly utility-scale solar, wind, and other green sources.

Furthermore, India’s current pace of solar capacity addition, 77 percent of the total capacity addition in FY 2022-23, indicates its future dominance in the power grid. Thus, a significant number of balancing resources would be needed when the sun is not shining. To meet this need, Indian policymakers have been implementing measures to ensure that energy storage systems (ESS) will facilitate this swift transition. In this article, we explore the current state of ESS in India including major pilots, government initiatives to boost the ecosystem, and the role it plays in decarbonising India’s power sector.

As per the latest report on ‘Optimal Generation Mix 2030’ by Central Electricity Authority (CEA), India would need 60.63 GW energy storage capacity by 2030[1]. This includes 18.9 GW of Pumped Storage and 41.65 BESS, accounting to a total storage of 336.4 GWh. As of March 2023, the total installed capacity of pumped storage stands at 4.7 GW in the country, with an additional 2.7 GW under construction. Thus, in addition to these projects under construction, an additional PHS capacity of 11.4 GW is required by 2030. According to the National Renewable Energy Laboratory (NREL), BESS is expected to have a more significant contribution to the capacity mix by the year 2047, with approximately 237 GW or 13 percent of the total installed capacity. This significant addition in BESS after 2030 is a result of falling capital costs and increased deployment of RE sources. These projections highlight the need for India to be ready to integrate a significant number of renewables into its power mix.

The forecasts point toward efforts needed to accelerate ESS implementation in India. By the next decade, coal might play a diminishing role in providing operating reserves, while ESS would ensure grid stability. This could be achieved by providing fast ramping flexibility, so that RE generation is balanced throughout the day and also meets the evening peak. ESS offers a wide range of services to facilitate the seamless integration of renewable energy (RE) into the grid. These services encompass vital functions such as providing electric inertia to ensure grid stability, regulating voltage through the injection or absorption of reactive power, conducting energy arbitrage during periods of low demand or low prices, and deferring Transmission & Distribution infrastructure requirements by reducing peak loads. Although, it should be noted that the role of ESS in providing peak requirement and total energy requirement is limited by 2030 due to the dominance of coal in the current electricity mix. India’s long-term ambition is to achieve net zero by 2070, however, according to the International Energy Agency (IEA) India’s power sector could achieve zero emissions well in advance[2]. In this scenario, ESS will not only meet demand in the absence of renewables but also support the base load for a longer period.

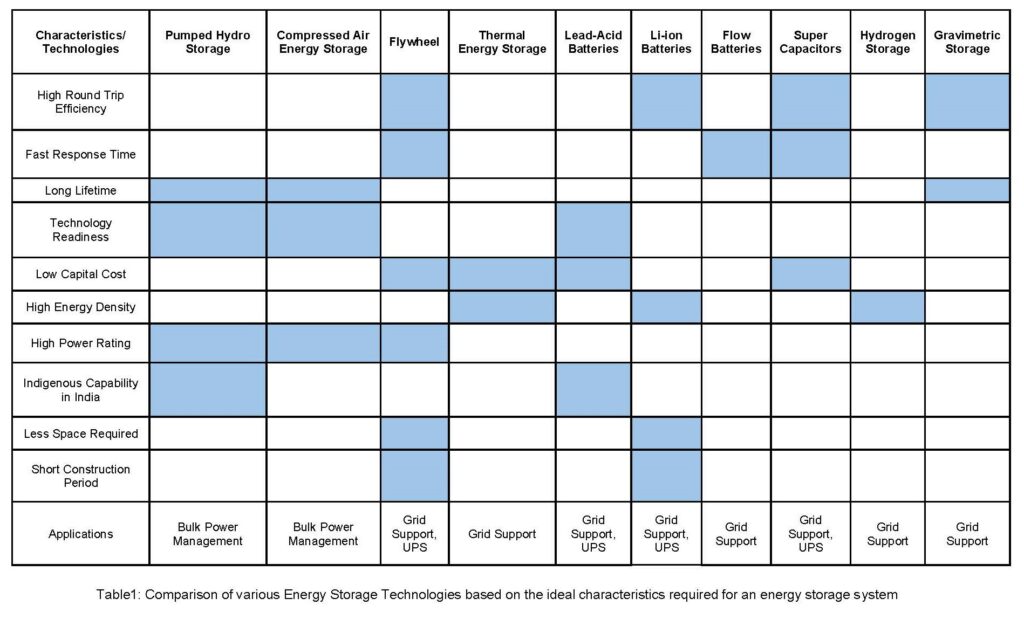

As India moves towards a net-zero future, ESS will play a significant role in its transformation. A highly renewable-dominant system would require ESS to serve a wide range of applications for resource adequacy, system stability, and renewables integration. This would require ESS to operate from a few seconds to several days. Therefore, a holistic approach towards ESS capacity additions is necessary to provide the required level of services. It is essential to focus on ESS technologies beyond lithium-ion chemistries to suit a wide range of applications. This is highlighted in Table 1, which outlines the operational parameters and applications of various ESS technologies.

Current State and Various Pilots of ESS

The development of ESS in India is still in its early stages, with pumped hydro storage (PHS) being the predominant technology, followed by battery energy storage systems (BESS). PHS is estimated to have a potential of 119 GW in India, against which the current capacity stands at 4.74 GW with 2.7 GW of storage under construction[3]. However, the implementation of grid-scale BESS has been slow, with the first grid-scale lithium-ion-based system commissioned only in 2019 in Rohini, Delhi by Tata-Power. The notable grid-scale battery energy storage system (BESS) projects that have been commissioned, include a 1 MW/0.5 MWh pilot project in Puducherry by PGCIL that combines Advanced Lead-acid and Li-ion (LFP) technologies, a 16 MW/8 MWh BESS project in Andaman & Nicobar Islands commissioned by NLC, and a 510 kWh Advanced Lead-acid & Li-ion project in Sahibabad by CEL. Furthermore, several upcoming BESS projects are underway, such as Sun Source Energy’s planned 2.15 MWh system in Lakshadweep, Tata Power’s 60.56 MWh and 120 MWh systems in Ladakh and Chhattisgarh respectively, and JSW Renew Energy’s ambitious plan for two standalone battery energy systems with a capacity of 500 MWh each. Lead-acid batteries are limited to behind-the-meter applications and hence their grid-scale applications are distant. Similarly, there have been only a few pilots of commercial grid-scale flow batteries, including vanadium redox batteries in Bangalore and Hyderabad.

In terms of thermal storage, ‘India One’, a 1 MW solar thermal power plant with 16 hours of thermal storage for round-the-clock operation became operational in Rajasthan. Among the chemical energy storage technologies, hydrogen storage is gaining momentum in India, especially with the launch of the National Green Hydrogen Mission (NHM). Also, several green hydrogen pilots have been launched, including a 100 kW Anion Exchange Membrane (AEM) based green hydrogen plant in Assam and a green hydrogen fueling station in Ladakh established by the National Thermal Power Corporation (NTPC).

India has a huge potential for repurposing its thermal power plants. With respect to this, Switzerland-based E2S Power, a company specialising in thermal energy storage solutions, and India Power Corporation Ltd (IPCL), a power utility firm, have signed an agreement for the installation of a pilot thermal energy storage system with a capacity of 250 kWh. This would entail utilising the existing infrastructure of thermal power plants, thus using renewable electricity to convert into heat using direct radiative heating, and further production of superheated steam at power generation facilities.

Government of India (GOI) Initiatives

Boosting PHS Adoption in India

Despite its enormous potential, an additional 8.9 GW of PHS projects are still awaiting approval from India’s Central Electricity Authority (CEA). With an aim to fast-track the progress, the Ministry of Power (MoP) proposed an amendment to the electricity rule in 2019, which would provide a peak power price of supply, thereby improving the bankability of PHS projects while attracting more participation from the private sector. A huge boost was provided in 2022, with the introduction of Hydro Purchase Obligation (HPO), which included PHS, thus enabling compliance with energy procured from hydro sources by the distribution utilities[4]. This represents ~3 percent of the total Renewable Purchase Obligation (RPO) by 2030. In Apr 2023, the MoP issued guidelines for PHS project development in the country. This entails leveraging project development experience from CPSU/SPSU and enabling competitive bidding to private developers, thus reducing lead time. Among others, the guidelines also focus on the allotment of project sites at exhausted mines, expediting clearances and enabling green finance. Moreover, a rationalisation of peak and off-peak tariff structures is also envisaged to monetise services like fast ramping, reactive power support etc.

Indigenization of Energy Storage Supply Chain

Supply chain amongst the electrochemical ESS route is largely import-dominated. To indigenize supply, the Cabinet panel approved the Production Linked Incentive (PLI) scheme with an outlay of 18,100 crores INR for manufacturing Advanced Chemistry Cell (ACC) based electrochemical battery storage[5]. While the scheme primarily aims at creating a value chain for electric vehicles, it also covers stationary storage applications. Currently, three companies have signed agreements to manufacture batteries with a capacity of around 95 GWh[6].

Battery Storage Scrappage Policy

In 2022, the Ministry of Environment, Forest and Climate Change (MoEFCC) introduced the Battery Waste Management Rules to encourage the responsible disposal of battery waste. The rules are based on Extended Producer Responsibility (EPR), which holds producers accountable for collecting and recycling materials from battery packs.

Round-the-clock (RTC) Power to Support High RE Integration

In February 2020, the Ministry of Power (MoP) released the draft guidelines for implementing RTC tenders with a focus on providing a firm power supply[7]. This means that the dispatchable power is combined with renewable energy (RE) sources, with RE contributing 51 percent of the annual energy supply and being available 90 percent of the time. The guidelines introduced the use of energy storage, thus promoting the integration of high RE. The Solar Energy Corporation of India (SECI) awarded the first RTC tender for a 400 MW capacity at 2.9 INR/kWh but the high battery costs are hindering the progress of RTC tenders. Moreover, with the increased scale of implementation, DISCOMs would be more inclined to purchase RTC power.

Market-based Procurement of Ancillary Services and Energy Storage Systems

In 2021, the Central Electricity Regulatory Commission (CERC) introduced new regulations for ancillary services, allowing energy storage to provide reserves and maintain grid frequency at 50 Hz[8]. As a result of the market-based mechanism, procurement of secondary and tertiary ancillary services can be traded in the day-ahead and real-time markets at a uniform clearing price, ensuring adequate reserves across the country, instead of being limited to specific load centers.

Solar Hybrid Policy with ESS

India’s National Solar Wind Hybrid Policy of 2018 acknowledges the potential of battery storage systems in enhancing the performance and capabilities of hybrid projects[9]. With battery storage, these projects can achieve a more stable and reliable power supply by reducing the intermittency of renewables. Additionally, battery storage enables higher energy output for a given capacity, maximising the utilisation of wind and solar resources. It also ensures the availability of firm power during specific periods, enhancing the overall reliability of the hybrid plant. Bidding factors for wind solar hybrid plants with battery storage include considerations such as minimum firm power output, allowing variability in power output, and unit price of electricity. The policy emphasises the integration of battery storage to optimise renewable energy utilisation, improve grid stability, and provide a consistent power supply.

With the nation transforming into a zero-carbon economy, the ESS will play a crucial role in the Indian Power sector in the coming decade and beyond. To further promote high ESS penetration, both Centre and State Governments need to enhance policy and financial support and explore new pilot projects for emerging technologies through international credit. In the face of supply chain disruptions and geopolitical uncertainties, India must invest in both near-term and viable mid to long-term ESS pathways to achieve a carbon-neutral future.

[1] https://cea.nic.in/wp-content/uploads/notification/2023/05/Optimal_mix_report__2029_30_Version_2.0__For_Uploading.pdf

[2]https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

[3] https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1930831

[4]https://powermin.gov.in/sites/default/files/Renewable_Purchase_Obligation_and_Energy_Storage_Obligation_Trajectory_till_2029_30.pdf

[5]https://heavyindustries.gov.in/writereaddata/UploadFile/ACC%20Scheme%20Notification%209June21.pdf

[6] https://pib.gov.in/PressReleasePage.aspx?PRID=1846078

[7] https://mnre.gov.in/img/documents/uploads/file_f-1595577684752.pdf

[8] https://cercind.gov.in/Regulations/SOR-167.pdf

[9] https://mnre.gov.in/img/documents/uploads/2775b59919174bb7aeb00bb1d5cd269c.pdf