Jaideep Saraswat, Nikhil Mall, Tushar Katiyar

As the need to intensify efforts in combating climate change grows, there is a notable surge in the adoption of solar photovoltaic (PV) technology to decarbonize the power sector. India, consistently demonstrating leadership on the global stage, has significantly increased its solar PV capacity to 73.318 GW, a remarkable escalation from a mere 6.7 GW in 2015-16[1]. This achievement is widely recognized globally, positioning India among the select nations making substantial progress towards achieving its 2030 targets outlined in the revised Nationally Determined Contributions (NDCs)[2].

The Government of India (GoI) is actively capitalizing on the transition to renewable electricity to bolster the nation’s manufacturing capabilities. It has implemented a range of carrot and stick policies, such as Basic Customs Duty (BCD), Modified Special Incentive Package Scheme (M-SIPS), Approved List of Modules and Manufacturers (ALMM), and Production Linked Incentive (PLI) Scheme Tranche-1 and Tranche-2. These measures have proven effective, resulting in a substantial expansion of manufacturing capacities. As of the close of 2023, India boasts a module manufacturing capacity of approximately 37 GW and a cell capacity of 6 GW. Projections indicate a growth in cell manufacturing capacity to 25 GW by 2025[3].

This blog delves into the ALMM strategy, examining its provisions and impact on India’s solar PV ecosystem. The Ministry of New and Renewable Energy (MNRE) introduced the “Approved Models and Manufacturers of Solar Photovoltaic Modules (Requirement for Compulsory Registration) Order” on January 2, 2019[4]. The ALMM Order outlines two key components: LIST-I, which specifies models and manufacturers of Solar PV Modules, and LIST-II, which specifies models and manufacturers of Solar PV Cells.

Examining ALMM

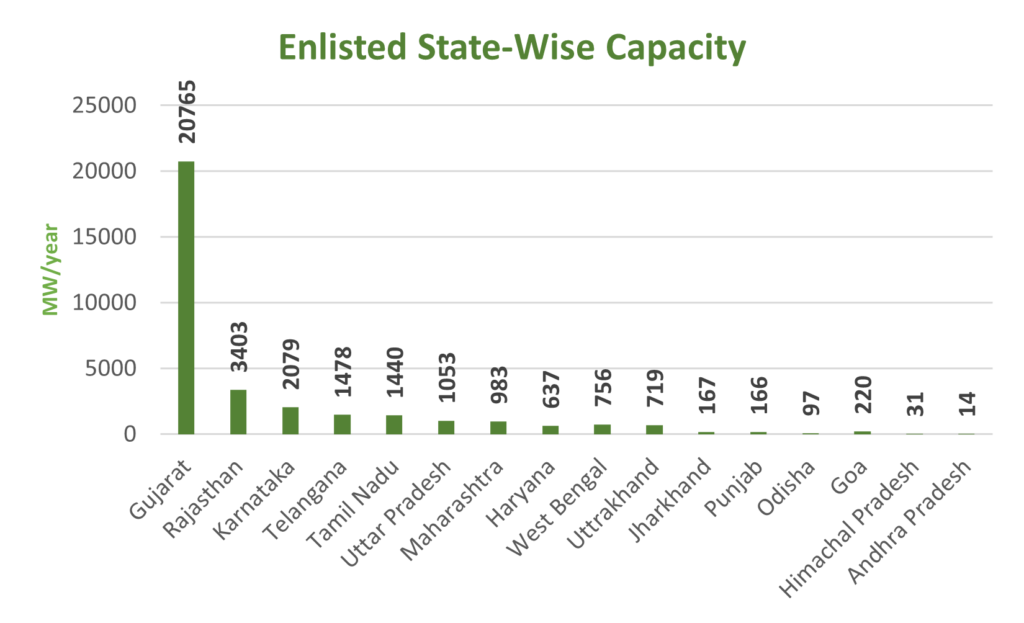

As per the latest ALMM revision[5], approximately 34 GW[6] of manufacturing capacity is registered (including provisionally admitted modules), involving 78 manufacturers. Figure 1 illustrates the distribution of manufacturing capacity across states, with Gujarat taking the lead at 20.765 GW, followed by Rajasthan in a distant second place with a manufacturing capacity of 3.403 GW—about 17 percent of Gujarat’s capacity. Furthermore, the average manufacturing capacity per manufacturer is approximately 127 MW[7], a figure significantly below what is needed to achieve economies of scale.

According to the ALMM order, only models and manufacturers included in ALMM List-I (of solar PV modules) are eligible for use in various government-related projects and programs, including Government Projects, Government-assisted Projects, Projects under Government Schemes & Programmes, Open Access, Net-Metering Projects, and those set up for the sale of electricity to the Government as per the guidelines issued by the Central Government under section 63 of the Electricity Act, 2003, and its amendments.

Although the implementation of the ALMM Order was initially deferred until the fiscal year 2023-24, implying that projects commissioned by March 31, 2024, would be exempted from procuring solar PV modules from ALMM, a recent order by the Minister of New and Renewable Energy states that the ALMM will be re-imposed from 1st April 2024[8]. This underscores that models and manufacturers under the ambit of ALMM will be the ones receiving benefits in the future.

Owing to the significance of the ALMM, there is a need to ensure that it is cognizant and inclusive of technologically superior modules. Currently, the modules registered under ALMM encompass Bifacial monocrystalline Passivated Emitter Rear Contact (PERC), Monofacial monocrystalline PERC, and multi-crystalline modules. Notably, innovative technologies such as Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction are currently absent from the list. TOPCon boast efficiencies around 22.5%[9], and heterojunction around 26%. Presently, under ALMM, the average efficiency stands at approximately 20.29%, with the maximum reaching 21.91% and the minimum set at 19%.

In recognition of the need to ensure the inclusion of high-quality modules in the scheme, the GoI has put forth initial measures such as establishing minimum efficiency limits for various applications. For utility and grid-scale power plants, the specified minimum efficiency for modules is 20%, while rooftop and solar pumping require modules with a minimum efficiency of 19.5%, and solar lighting necessitates modules with a minimum efficiency of 19%. These initiatives spearheaded by the GoI have made substantial strides in augmenting the solar PV manufacturing capacity.

Looking Ahead

Manufacturers should be encouraged to embrace advanced technologies such as ToPCon and beyond. Beyond the advantage of higher efficiencies, these modules excel in various parameters like output power and temperature coefficient performance degradation, factors crucial for developers when devising a PV project. ToPCon modules offer superior product and performance warranties when compared to PERC counterparts. These robust warranties are instrumental in fostering confidence in the enduring reliability and longevity of solar modules, thereby making a significant contribution to the overall industry growth. Additionally, experiences in other global markets indicate that the costs of newer technologies are approaching those of the prevailing workhorse, namely PERC[10]. What adds to the intrigue is that transitioning from PERC to TOPCon in the manufacturing process involves relatively minor adjustments, incorporating only a few additional steps. This implies that existing manufacturing lines can be reconfigured to produce these advanced technologies[11].

Another important aspect to underscore here is that manufacturing firms must consistently allocate resources for Research & Development (R&D). The PV technology cycle is notably brief, and within a few years, new technologies may become outdated, giving way to entirely new advancements, as observed in the transitions from Back Surface Field (BSF) to PERC. Recognizing that staying at the forefront of innovation is not solely the responsibility of manufacturing companies, and considering India’s ambition to emerge as a global leader in this sector, it becomes imperative for the GoI to provide essential support to these manufacturing entities.

[1] https://iced.niti.gov.in/energy/electricity/generation/capacity

[2] https://ccpi.org/

[3] https://www.icra.in/Rating/DownloadResearchSummaryReport?id=5344#:~:text=ICRA%20expects%20the%20solar%20PV,into%20cell%20and%20wafer%20manufacturing

[4] https://cdnbbsr.s3waas.gov.in/s3716e1b8c6cd17b771da77391355749f3/uploads/2023/08/2023080832.pdf

[5] https://mnre.gov.in/notice/updated-24-01-2024-list-i-under-almm-order-for-solar-pv-modules/

[6] Difference between ALMM-registered capacity and actual capacity as not all manufacturers are registered with ALMM.

[7] Excluding Outliers which in this case is 10

[8] https://www.ndtvprofit.com/business/govt-to-reimpose-approved-list-for-solar-manufacturers-from-april-1

[9] https://static.trinasolar.com/sites/default/files/DT-M-0042%20D%20Datasheet_Vertex_NEG21C.20_EN_2023_C_web.pdf

[10] https://www.pv-magazine.com/2024/01/17/pv-manufacturing-in-europe-ensuring-resilience-through-industrial-policy/

[11] https://bluebirdsolar.com/blogs/all/difference-between-mono-perc-hjt-topcon-technology